|

|

本帖最后由 casper 于 2016-1-24 08:17 编辑

凤凰财经

*12月购汇率升至三个月新高,显示企业和个人购汇意愿强烈

*外汇局称,企业资产负债结构已发生调整,利于降低未来风险

衡量中国企业和个人购汇意愿的指标,12月升至近三个月高点,显示当月外汇储备和外汇占款创纪录下降,与市场购汇冲动再度上升有直接关系。

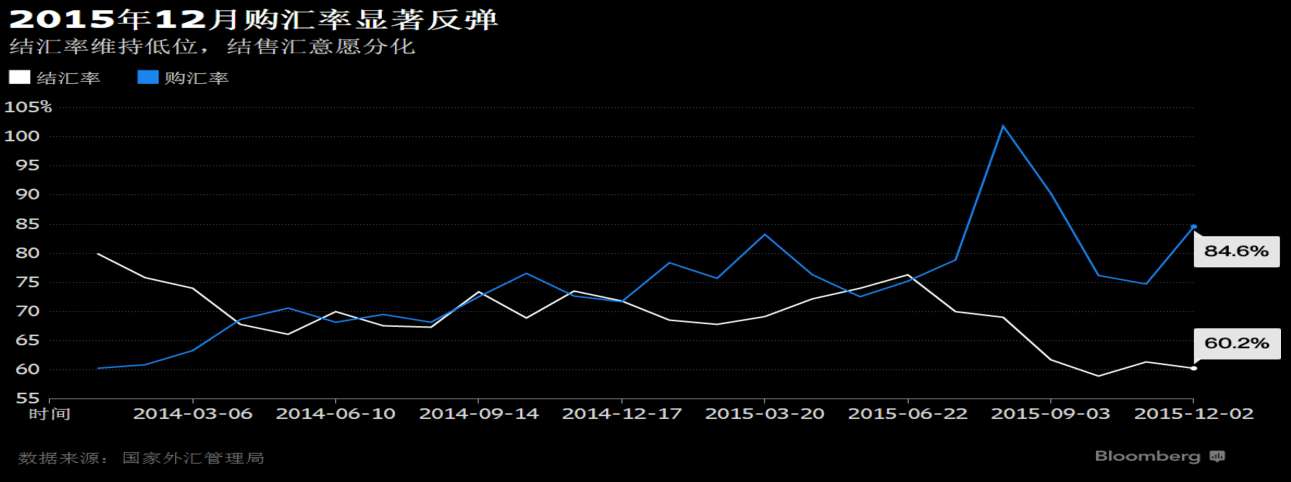

银行代客售汇占涉外支付的比重,即购汇率,12月大幅上升。国家外汇管理局周四发布数据显示,当月银行代客结售汇逆差达894亿美元,彭博计算当月购汇率达84.6%,较11月的74.8%显著反弹,并创年内第三高点。同时,当月结汇率降环比下降1.2个百分点至60.2%,

购汇率与结汇率一升一降,显示在人民币贬值压力持续的背景下,企业和居民购汇意愿强烈,并惜售手中持有的外汇资产。12月人民币兑美元大幅贬值达1.47%,尽管当月贸易顺差高达600.9亿美元,外汇储备仍下降1083亿美元,显示多数出口企业选择将持有外汇进账而非结汇。

2015年12月购汇率显著反弹

德国商业银行驻新加坡的高级经济学家周浩表示,12月人民币贬值比较快,市场也会有反应,体现为购汇意愿上升。他进一步称,鉴于目前资本流出压力较大,央行会继续采取严格的资本管控举措,市场干预也会持续。

高盛分析师邓敏强在对外汇局数据点评报告指出,高盛测算的12月中国资金流出达约970亿美元,较11月的390亿美元显著增加。

贬值预期

外汇局结售汇数据凸显12月人民币兑美元加速贬值给市场带来的心理影响。彭博汇总的66家机构预估中值显示,今年第四季在岸人民币兑美元会跌至6.75。在接受彭博调查的45位分析师中,最为看空人民币的荷兰合作银行料今年人民币会跌到7.60。

华侨银行高级经济学家谢栋铭在采访中表示,银行代客远期净售汇升至1151亿元人民币,表示12月企业对人民币贬值预期的重新升温,即便企业虽然面临远期保证金等更高的套期保值成本,还是愿意以较高的成本作保值。

“结合中国央行在1月份一系列收紧资本外流渠道以及适度的资本管制,都是为了打破市场对人民币政策的预期,才能控制资本外流,”他说。

12月,境内银行代客涉外收付款逆差创有数据以来最大。招商银行[-0.07% 资金 研报]同业金融总部高级分析师刘东亮对此表示,人民币回流境内正在减少,流向境外的压力正在加大,银行代客结售汇逆差数据显示企业及居民配置美元资产意愿强烈。

加强管控

彭博本周报道,中国开始对银行办理居民个人外汇业务加强管控,防止公众对人民币资产的信心动摇,爆发大规模换汇潮。

外汇局在周四的答记者问中称,2015年全年购汇率为81%,较2014年提高12个百分点。这“说明企业外汇支出中来自购汇的增多而来自融资的减少,相应地2015年境内外汇贷款余额下降1006亿美元。”

监管层仍对管控相关风险表现出信心。外汇局文章续称,近期部分企业主动进行资产负债结构调整,这有利于降低未来的外债偿还风险,跨境资金流出对国内流动性、经济金融运行等方面的影响依然可控。

面对去年8月汇改后购汇冲动大幅飙升,央行、外汇局采取多项措施进行抑制,包括对企业即、远期购汇采取窗口指导和收取保证金等。不过外汇局文章表示,这些都在加强监测、规范业务、打击投机和违法违规范围内,“截至目前并没有出台任何限制购汇和付汇的新规定。”

新华社:恶意做空人民币或将面临法律严惩

凤凰网

新华社在一篇评论文章中称,随着中国央行采取措施来稳定人民币汇率,一些试图做空人民币的“激进”投机客将遭遇巨大损失。

新闻配图

新华社在一篇评论文章中称, 随着中国央行采取措施来稳定人民币汇率,一些试图做空人民币的“激进”投机客将遭遇巨大损失。

鲁莽投机和恶意做空将面临更高的交易成本甚至可能是严重的法律后果,中国政府试图改善市场监管机制和法律体系。

中国政府拥有充足的资源和政策工具来确保经济形势处于控制之下,并且应对任何外部挑战。

该评论来自最新刊发的新华社英文评论,结尾部分强调做空人民币的投机客将遭遇巨大损失,受到法律严惩。

以下为新华社全文:

Commentary: Chinese economic transition testing global investors' wisdom, courage

Jan. 22, 2016 (Xinhua) -- As the Chinese economy is undergoing profound restructuring and transition, international investors seem to be split in their judgment about the prospects for China's capital market.

Some people believe that the Chinese capital market is experiencing a major crisis, of which they try to take advantage with speculative actions and even vicious shorting activities.

The latest example is that some radical speculators tried to short sell the Chinese currency yuan, which has been depreciating against the U.S. dollar recently. However, with the Chinese monetary authority taking effective measures to stabilize the value of the yuan, those speculators are expected to suffer huge losses.

Meanwhile, many other investors see new opportunities in the transformation of the Chinese economy.

According to data from the London-based consulting firm Preqin Ltd, in 2015, global venture capital made 1,555 investments in China's startups with a total worth of 37 billion U.S. dollars, up 147 percent over the previous year, showing the investors' confidence in China's pro-innovation policy and business-friendly environment.

In a mature market economy, both speculative shorting and long-term investment are free choices of investors, and therefore should not be labeled as "right or wrong" or "good or bad."

But given the unique nature of the Chinese economy, currently the world's second largest, it should be fair to say that the choices made on China often reflect an investor's wisdom and courage.

As an old Chinese saying goes: To catch a big fish, one must cast a long line. The ancient Chinese wisdom fits the current Chinese economic situation well.

Many leading economists and scholars have pointed out that while China's economic restructuring is a challenging and arduous mission and the transitional period could be lengthy and painful, China is at no risk of a recession and the current 6.9 percent economic growth rate is still good enough to sustain the country's long-term prosperity.

Meanwhile, with the Chinese government actively pushing forward a series of fundamental reforms and supporting innovation-based business startups, both domestic entrepreneurs and foreign investors are expected to benefit from the economic restructuring process.

For example, the government has spared no efforts to cut excessive production capacity, boost domestic consumption and encourage the development of the service sector. It has also granted more market access to private capital and foreign investment.

The latest report from the American Chamber of Commerce in China showed that last year nearly two thirds of its member companies made profit in China, and three quarters saw good investment returns. The report also found that most of the member companies were optimistic about the future growth of the Chinese market, and over 90 percent of them viewed innovation as the key to their future success in China.

Asmart, far-sighted investor would seize the opportunity arising from China's economic restructuring, and achieve a win-win outcome by investing in China's future and reaping the fruits of China's reform and robust new economy.

As for those who want to bet on the "ultimate failure" of the Chinese economy, they should look back at the past four decades, which witnessed China's growth from an underdeveloped economy into a global economic powerhouse through continuous reform and opening up.

They should also take into consideration the fact that the Chinese government has been constantly improving the country's market regulatory system and legal system. As a result, reckless speculations and vicious shorting will face higher trading costs and possibly severe legal consequences.

And just as proved in the yuan exchange rate case, the Chinese government has sufficient resources and policy tools to keep the overall economic situation under control and cope with any external challenges.

|

|